# Read from a raw csv file

raw.data <- read.table("./data/data.us.csv", sep = ",", header = T)

# When you have the dates in the original csv file

xts.data <- xts(raw.data, order.by = as.Date(raw.data$date, "%m/%d/%Y"))

# When you don't have the dates in the original csv file but know the starting date

date = seq(as.Date("1960/3/1"), by = "3 month", length.out = nrow(raw.data))

xts.data <- xts(raw.data[,-1], order.by = date, frequency = 3)Read and Define the Time Series (TS) Objects

Read from a Saved File

These functions reads a file without a TS structure and then defines the TS object.

This function reads and declares the TS structure from the begining.

# Note that this is a TS with a zoo structure

ts.data <- read.zoo("./data/data.us.csv", index.column = 1, sep = ",", header = T, format = "%m/%d/%Y")

# Or...

ts.data <- ts(raw.data[,2:4], frequency = 4, start = c(1960,1))

# One can convert the TS-zoo into a xts...

xts.data <- as.xts(ts.data)Read from Online Sources

There are two main ways to get data into R: get the data into Excel or a csv or download for an online source. There are built-in package to get the data directly for the web in a predefined format. The table below shows the most popular sources and packages that one can use.

| Sources | R-Package | Web Pages |

|---|---|---|

| Yahoo, FRED, Google, Onda | quantmod |

Link |

| International Monetary Fund (IMF)1 | IMFData or imfr |

Link |

| World Bank’s WDI | WDI |

Link |

| OECD2 | rsdmx |

Link |

| Penn World Tables | pwt |

Link |

| International Labor Organization (ILO) | rsdmx |

Link |

One can use the getSymbols function with a previous search in the web pages and download directly into R.

getSymbols("GDPC1", src = "FRED")

getSymbols("PCEPILFE", src = "FRED")

getSymbols("FEDFUNDS", src = "FRED")

names(GDPC1) <- "US Real GDP"

names(PCEPILFE) <- "Core PCE"

names(FEDFUNDS) <- "FED Rate"Subset and Extract

# Federal funds rate, montly data from January 1980 to March

FEDFUNDS["1980-01-01/1980-03-01"] FED Rate

1980-01-01 13.82

1980-02-01 14.13

1980-03-01 17.19# Real GDP, quarterly data, for in 2006

GDPC1["2006"] US Real GDP

2006-01-01 15244.09

2006-04-01 15281.52

2006-07-01 15304.52

2006-10-01 15433.64# End of period inflation rate from 2000 to 2005

PCEPILFE[format(index(PCEPILFE["2000/2005"]), "%m") %in% "12"] Core PCE

1959-12-01 17.029

1960-12-01 17.255

1961-12-01 17.458

1962-12-01 17.677

1963-12-01 17.972

1964-12-01 18.201Identify ’NA’s, Fill and Splice

# Set missings into the series...

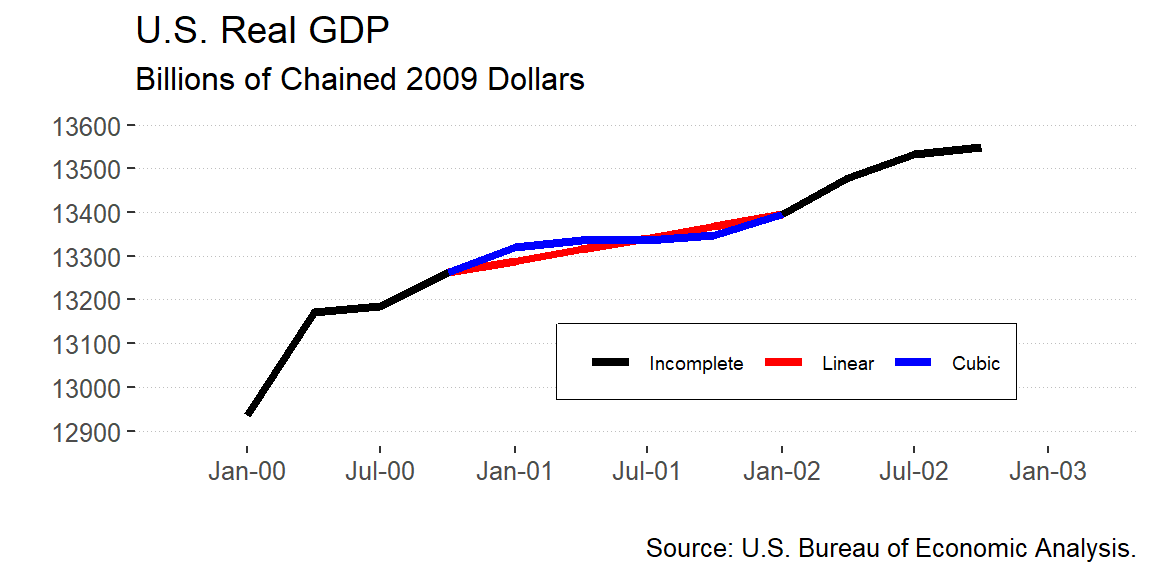

gdp.miss <- GDPC1["2000/2002"]

gdp.miss["2001"] <- NA# Identify the NAs

gdp.miss[is.na(gdp.miss)]

# Show numbers without NAs

na.omit(gdp.miss)# Fill missing with the last observarion or with the first non-missing

# observation

cbind(gdp.miss, na.locf(gdp.miss), na.locf(gdp.miss, fromLast = T)) US.Real.GDP US.Real.GDP.1 US.Real.GDP.2

2000-01-01 12935.25 12935.25 12935.25

2000-04-01 13170.75 13170.75 13170.75

2000-07-01 13183.89 13183.89 13183.89

2000-10-01 13262.25 13262.25 13262.25

2001-01-01 NA 13262.25 13394.91

2001-04-01 NA 13262.25 13394.91

2001-07-01 NA 13262.25 13394.91

2001-10-01 NA 13262.25 13394.91

2002-01-01 13394.91 13394.91 13394.91

2002-04-01 13477.36 13477.36 13477.36

2002-07-01 13531.74 13531.74 13531.74

2002-10-01 13549.42 13549.42 13549.42# Fill missing values with linear interpolation and bubic spline

cbind(gdp.miss, na.approx(gdp.miss), na.spline(gdp.miss, method = "fmm")) US.Real.GDP US.Real.GDP.1 US.Real.GDP.2

2000-01-01 12935.25 12935.25 12935.25

2000-04-01 13170.75 13170.75 13170.75

2000-07-01 13183.89 13183.89 13183.89

2000-10-01 13262.25 13262.25 13262.25

2001-01-01 NA 13288.96 13319.23

2001-04-01 NA 13315.08 13335.55

2001-07-01 NA 13341.50 13337.02

2001-10-01 NA 13368.20 13348.30

2002-01-01 13394.91 13394.91 13394.91

2002-04-01 13477.36 13477.36 13477.36

2002-07-01 13531.74 13531.74 13531.74

2002-10-01 13549.42 13549.42 13549.42

Transformations, Combine and Change Frequency

Basic Function Transformations

| Transformation | Command |

|---|---|

| Logarithm | log(y) |

| Lag: \(L^{n} y_{t} = y_{t-1}\) | lag(y,n) |

| Difference: \(\Delta y_{t} = y_{t} - y_{t-1}\) | diff(y) |

| Moving average: \(\bar{y}^{n}_{t} = \frac{1}{n} \sum^{n-1}_{i=0} y_{t-i}\) | rollapply(y, n, FUN = mean) |

| Cumulative sum: \(y^{s}_{t} = \sum^{t}_{i=0} y_{i}\) | cumsum(y) |

# Transformations

xts.gdp$lgdp <- log(xts.gdp$gdp)

xts.gdp$lgdp_1 <- lag(xts.gdp$lgdp, 1)

xts.gdp$dlgdp <- diff(xts.gdp$lgdp)

xts.gdp$mov.avg5_lgdp <- rollapply(xts.gdp$lgdp, 5, FUN = mean)

xts.gdp$cu.sum_lgdp <- cumsum(xts.gdp$lgdp)Period aggregation

# Get a date index on a lower frequency

periodicity(xts.gdp)Quarterly periodicity from 1947-03-01 to 2023-03-01 years <- endpoints(xts.gdp, on = "years")

# Aggregate to first/end of period

xts.gdp.a.firs <- period.apply(xts.gdp, INDEX = years, FUN = first)

xts.gdp.a.last <- period.apply(xts.gdp, INDEX = years, FUN = last)

# Aggregate to average of period

xts.gdp.a.mean <- period.apply(xts.gdp, INDEX = years, FUN = mean)

# Aggregate to sum of period

xts.gdp.a.sum <- period.apply(xts.gdp, INDEX = years, FUN = sum)

# Aggregate to min/max of period

xts.gdp.a.min <- period.apply(xts.gdp, INDEX = years, FUN = min)

xts.gdp.a.max <- period.apply(xts.gdp, INDEX = years, FUN = max)# Putting all together...

cbind(xts.gdp["2000/2001"], xts.gdp.a.firs["2000/2001"], xts.gdp.a.last["2000/2001"],

xts.gdp.a.mean["2000/2001"], xts.gdp.a.sum["2000/2001"], xts.gdp.a.min["2000/2001"],

xts.gdp.a.max["2000/2001"]) QRT.GDP FOP.GDP EOP.GDP AVG.GDP SUM.GDP MIN.GDP MAX.GDP

2000-03-01 12935.25 NA NA NA NA NA NA

2000-06-01 13170.75 NA NA NA NA NA NA

2000-09-01 13183.89 NA NA NA NA NA NA

2000-12-01 13262.25 12935.25 13262.25 13138.04 52552.14 12935.25 13262.25

2001-03-01 13219.25 NA NA NA NA NA NA

2001-06-01 13301.39 NA NA NA NA NA NA

2001-09-01 13248.14 NA NA NA NA NA NA

2001-12-01 13284.88 13219.25 13284.88 13263.42 53053.67 13219.25 13301.39Combine series

# Aggregate data to quarterly averages

quarts <- endpoints(xts.inf, on = "quarters")

xts.inf.q.avg <- period.apply(xts.inf, INDEX = quarts, FUN = mean)

# Merge monthly and quarterly data

xts.inf <- merge(xts.inf, xts.inf.q.avg, join = "left")

colnames(xts.inf) <- c("EOP.inf", "AVG.inf")

xts.inf["2001"] EOP.inf AVG.inf

2001-01-01 81.592 NA

2001-02-01 81.736 NA

2001-03-01 81.821 81.71633

2001-04-01 81.951 NA

2001-05-01 81.970 NA

2001-06-01 82.154 82.02500

2001-07-01 82.366 NA

2001-08-01 82.406 NA

2001-09-01 81.939 82.23700

2001-10-01 82.516 NA

2001-11-01 82.683 NA

2001-12-01 82.702 82.63367# Merge two series and exclude the missing cases from both sides

merge(xts.gdp["2001"], xts.inf["2001"], join = "inner") QRT.GDP EOP.inf AVG.inf

2001-03-01 13219.25 81.821 81.71633

2001-06-01 13301.39 82.154 82.02500

2001-09-01 13248.14 81.939 82.23700

2001-12-01 13284.88 82.702 82.63367Summary Charts

# Plot separate series under the zoo TS structure

plot(ts.data[,c(1:2)], plot.type = "multiple",

col = c("blue","red"),

lty = c(1,1), lwd = c(2,2),

main = "",

ylab = c("FED Rate","Inflation"),

xlab = "Date")

legend(x = "topright",

legend = c("FED Rate","Inflation"),

col = c("blue","red"), lty = c(1,1), lwd = c(2,2))# Plot series together under the zoo TS structure

plot(ts.data[,c(1:2)], plot.type = "single", ylim = c(0,20),

col = c("blue","red"),

lty = c(1,1), lwd = c(2,2),

ylab = "Percentage points",

xlab = "Date")

legend(x = "topright",

legend = c("Fed Rate","Inflation"),

col = c("blue","red"), lty = c(1,1), lwd = c(2,2))ggplot() +

geom_line(data = xts.data, aes(x = Index, y = ffr, color = "Fed Rate"), linetype = 1, size = 1) +

geom_line(data = xts.data, aes(x = Index, y = infl, color = "Inflation"), linetype = 1, size = 1) +

scale_color_manual(labels = c("Fed Rate","Inflation"),

breaks = c("Fed Rate","Inflation"),

values = c("Fed Rate"="red","Inflation"="blue")) +

scale_y_continuous(limits=c(0,20), breaks=seq(0,20,5)) +

scale_x_date(limits = as.Date(c("1960-03-01","2018-03-01")), date_breaks = "10 years", date_labels = "%Y") +

theme_hc() +

theme(legend.position = c(0.82,0.85),

legend.direction = "horizontal",

legend.background = element_rect(fill="transparent"),

panel.grid.major.y = element_line(size = 0.1, colour = "grey", linetype = 3),

panel.grid.major.x = element_line(colour = "transparent"),

panel.grid.minor.x = element_line(colour = "transparent")) +

labs(x = "", y = "", color = "",

title = "Federal Funds Rate and PCE Inflation",

subtitle = "Percentage points",

caption = "Source: U.S. Bureau of Economic Analysis.")